The new GST rates are effective from September 22, 2025, bringing significant relief to consumers across multiple sectors. While petrol and diesel remain outside GST coverage, the comprehensive tax reforms will impact vehicle prices and overall transportation costs.

Table of Contents

Understanding the GST Framework Changes

The Goods and Services Tax Council has approved big cuts in GST rates to be applicable from September 22, 2025. Most daily-use items will now be covered under two tax slabs: 5% and 18%. This major restructuring simplifies the tax system while providing substantial savings to consumers.

The reforms represent the most significant GST overhaul since its introduction, aimed at making essential goods more affordable and boosting economic growth during the festive season.

Vehicle Sector Gets Major Relief

They’ve also brought down the GST charge from 28% to 18% for all petrol, diesel, CNG and LPG vehicles under 4 metres. This dramatic reduction will make compact cars significantly more affordable for middle-class families.

The cess removal on various vehicle categories further enhances savings. Small cars, SUVs, and even luxury vehicles will see price reductions ranging from 5% to 15%, depending on their specifications and engine capacity.

Impact on Transportation Costs

While direct GST on fuel remains absent, the vehicle price reductions will lower transportation costs for businesses and individuals. Reduced vehicle acquisition costs translate to lower operational expenses for fleet operators and commercial users.

The savings on vehicle purchases can offset rising fuel costs, providing indirect relief to consumers dealing with petroleum price volatility.

GST Rate Structure Comparison

| Category | Previous Rate | New Rate | Effective Date |

|---|---|---|---|

| Small Cars (<4m) | 28% + Cess | 18% | September 22, 2025 |

| Large SUVs | 28% + High Cess | 28% + Reduced Cess | September 22, 2025 |

| Daily Use Items | 12%/18%/28% | 5%/18% | September 22, 2025 |

| Essential Goods | 5% | 5% (Unchanged) | September 22, 2025 |

| Luxury Items | 28% | Varies | September 22, 2025 |

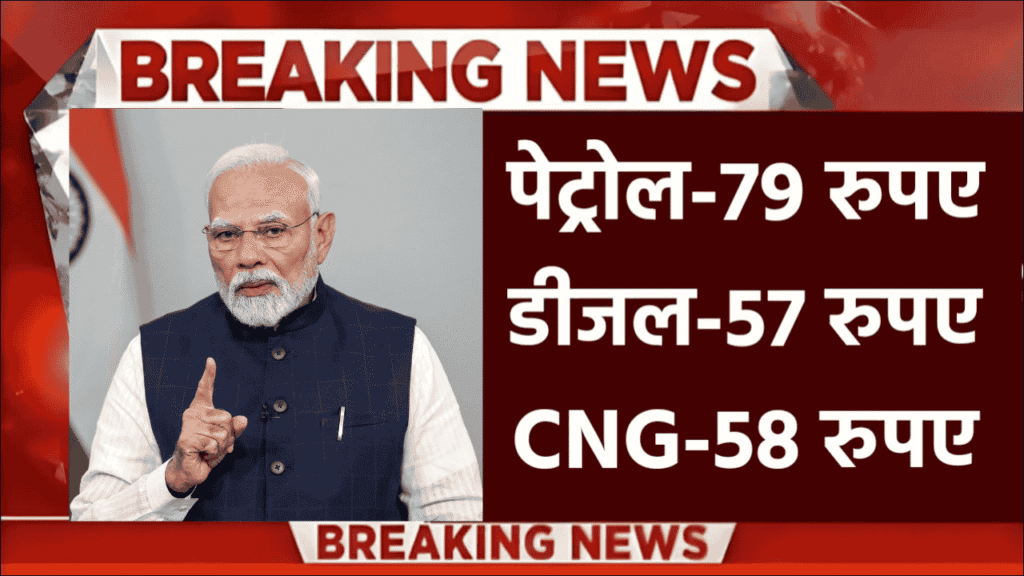

Fuel Taxation Reality

Petrol and diesel are not covered under the GST (Goods and Services Tax) regime. These fuels continue to be taxed through traditional methods such as VAT (Value Added Tax), central excise duty, and central sales tax.

State governments retain control over fuel pricing through VAT, while the central government manages excise duties. This dual taxation system keeps fuel prices outside the unified GST framework.

Economic Benefits Expected

The GST reforms aim to boost consumption during the festive season and stimulate economic growth. Lower vehicle prices could increase automobile demand, supporting the manufacturing sector and related industries.

Small businesses will benefit from simplified compliance requirements and reduced tax burdens on essential inputs, potentially leading to lower prices for consumers across various sectors.

Implementation and Compliance

The revised rates come into force from 22nd September 2025, with manufacturers expected to announce new pricing structures around the same time. Businesses must update their systems and pricing to comply with the new rates.

The government has streamlined GST procedures to ease the transition, ensuring minimal disruption to commerce and trade activities.

Consumer Savings Potential

Vehicle buyers can expect significant savings, especially on compact cars and SUVs. All Nexon variants get a price cut in the range of 5.77% to 9.92%, indicating substantial relief for popular models.

The timing coincides with the festive season, potentially boosting automobile sales and providing consumers with better value for their purchases.

Future Outlook

While direct GST on petrol and diesel remains unlikely in the near term, the current reforms demonstrate the government’s commitment to tax rationalization and consumer relief.

The success of these measures could pave the way for further reforms, potentially including fuel price stabilization mechanisms or additional subsidies for essential transportation needs.

Frequently Asked Questions

Q: Are petrol and diesel prices directly affected by the new GST rates?

A: No, petrol and diesel remain outside GST coverage and are taxed through VAT and excise duties.

Q: When do the new GST rates take effect?

A: The revised GST rates are effective from September 22, 2025, across all applicable categories.

Q: How much can I save on a new car purchase?

A: Savings range from 5-15% depending on vehicle type, with compact cars seeing the maximum benefit.